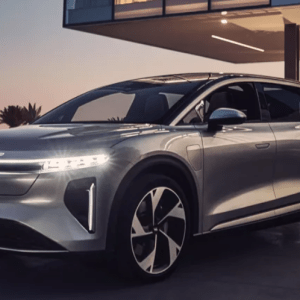

Lucid Motors is at a critical juncture. CEO Marc Winterhoff faces growing pressure as the company rolls out its highly anticipated SUV, the Gravity. He recently admitted that progress on this model isn’t where they hoped it would be by now.

“We’ve aimed for more progress by this time,” he told Yahoo Finance after the company released its Q2 earnings. However, he remains optimistic, predicting a significant ramp-up in Gravity production in the latter half of the year.

For 2025, Lucid expects to produce between 18,000 and 20,000 electric vehicles (EVs), down from an earlier target of 20,000. So far this year, they’ve manufactured 6,075 vehicles, marking a significant increase compared to previous periods.

To boost production, Lucid plans to bring a second shift online at its Arizona factory. Earlier supply chain issues, particularly shortages from China, disrupted their production schedule. Still, Winterhoff believes those problems are largely resolved.

One challenge for the company is the recent loss of the federal EV tax credit, which may hinder sales, especially for their Air sedan. Winterhoff mentioned they have plans to manage this, likely through incentives like discounts or financing options. However, these measures might deepen their financial losses.

Currently, Lucid is grappling with profitability. Reports state that the company’s losses amount to about $161,000 for each car produced, while rival Rivian has achieved profitability in its operations. Winterhoff is focusing on volume, stating, “Volume solves all problems.”

When asked about their expectations for Q2, Lucid missed revenue projections slightly, reporting $259.4 million instead of the anticipated $262.4 million. They ended the quarter with $4.86 billion in liquidity, essential for managing cash flow as they continue to burn cash.

Interestingly, in July, Lucid formed a partnership with Uber to provide 20,000 vehicles for a future robotaxi service. This initiative may lead to new revenue streams. Additionally, Lucid vehicles will soon have access to over 23,000 Tesla Superchargers, boosting convenience for drivers.

Looking forward, experts note that the road to profitability for new EV makers like Lucid is complex. Volume production could help reduce fixed costs, but executives are aware it’s only part of the solution.

The EV market continues to evolve rapidly. According to a recent survey, nearly 15% of new car buyers in the U.S. are now considering electric vehicles, indicating a growing interest. As Lucid navigates its challenges, the wider market trends suggest that demand for EVs will only increase.

For further insights on electric vehicles and market trends, consider checking resources from reputable news sources like Bloomberg or Yahoo Finance.

Source link

Gravity, Marc Winterhoff, Lucid, Winterhoff