The recent rise in memory chip prices has created stark contrasts in the stock market, with some companies thriving while others struggle. This surge in demand is particularly affecting firms like Nintendo and major PC brands, which are facing serious profitability concerns. In contrast, memory manufacturers are experiencing unprecedented gains.

A recent report highlighted that a benchmark for global consumer electronics companies dropped by 12% since late September. Meanwhile, memory chip makers, including Samsung, have seen their stocks skyrocket more than 160%. Analysts are now focused on which companies can withstand the pressure by securing supplies, hiking prices, or redesigning their products to use less memory.

Vivian Pai, a fund manager at Fidelity International, pointed out a crucial risk that some might overlook: “Current valuations often assume disruptions will ease within one or two quarters. We believe that the tight market could last longer, possibly throughout the year.”

These memory chip shortages are often mentioned in earnings calls, raising alarms among investors. For example, Qualcomm saw its stock drop over 8% after announcing that memory constraints would impact phone production. Similarly, Nintendo’s shares tumbled after warning about profit margins being squeezed.

Logitech’s shares have fallen about 30% from their November peak, as high chip prices dampen expectations for PC sales. Chinese firms like BYD and Xiaomi are also feeling the pinch from these chip shortages, resulting in sluggish stock performance.

According to Charu Chanana, chief investment strategist at Saxo, “Memory prices have shifted from background chatter to headline news this earnings season. The market knows about the tight supply, but now we question how long it will last.”

The surge in AI infrastructure spending—led by companies like Amazon—is shifting production towards high-bandwidth memory, further straining supply chains. This has prompted some analysts to call it a “supercycle,” breaking the typical patterns of boom and bust in memory supply.

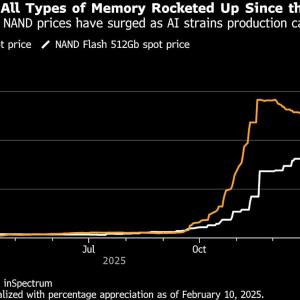

Spot prices for DRAM have soared over 600% recently, even with weak demand for products like smartphones and cars. AI’s expanding needs for NAND chips are driving prices up even further.

Memory chip companies have become standout performers in tech stocks. For instance, SK Hynix’s shares have risen by over 150% since September. Meanwhile, Japan’s Kioxia and Taiwan’s Nanya have seen gains around 280%, and Sandisk has climbed more than 400% in the same period.

Looking at history, Jian Shi Cortesi, a fund manager at GAM Investment Management, remarked that typical memory cycles last around 3-4 years. “This cycle has already exceeded previous ones in both duration and intensity, with no signs of demand slowing,” she noted.

In summary, the memory chip market is undergoing significant changes. From soaring prices to shifting demands and the impact of AI, various tech stocks are feeling the effects differently. As this landscape continues to evolve, keeping a close eye on market trends could provide valuable insights into the future of technology investments.

Source link

Bloomberg, Memory prices, Apple Inc., chip shortages, memory chip, Memory, chip prices, unprecedented heights, Fidelity International, product prices